Ethereum: What happens when bitcoin loans appear?

Ethereum: What Will Happen When Bitcoin Lending Starts to Appear

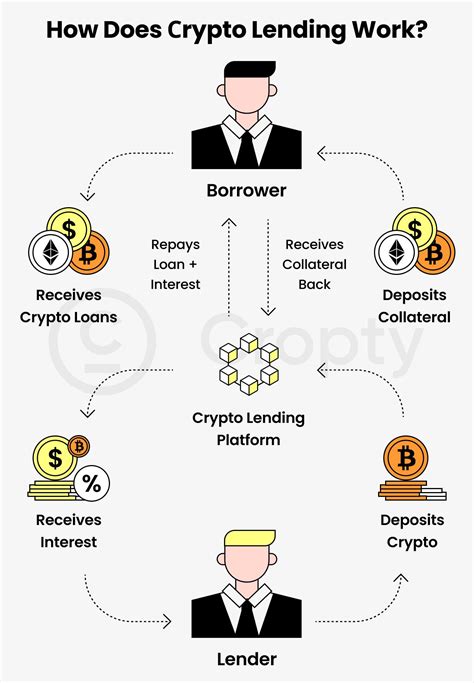

The emergence of Bitcoin lending has sparked heated debate in the cryptocurrency community. While some see it as a game-changer, others fear that it could lead to excessive debt and a potentially disastrous outcome for the global economy.

In this article, we’ll explore the potential impacts of Bitcoin lending and examine what will happen when it starts to appear.

The Debt Problem

Traditional loans provide funds to the borrower in exchange for repayment of the principal of the loan plus interest. However, when it comes to digital currencies like Bitcoin, there’s a fundamental flaw: the total supply of Bitcoin is capped at 21 million, meaning that no new Bitcoins can be created. This limits the possibilities for lending and borrowing.

Theoretically, if lending were introduced into the system, an infinite number of people could theoretically borrow from each other without having to worry about running out of available funds. However, this would create a paradoxical situation: if everyone borrowed money at an interest rate that “creates added value,” wouldn’t it be impossible for anyone to repay their loan?

The Interest Rate Puzzle

When we say that Bitcoin lending is based on value creation, we mean the idea that interest rates can be designed to incentivize people to hold onto their holdings. In a traditional lending system, interest is simply a fee for borrowing money. With Bitcoin lending, however, the interest rate is tied to the value of the underlying asset (in this case, Bitcoin itself).

If the interest rate is 10% per year and an investor borrows $100 worth of Bitcoin, they will have to repay $110 per year. If the price of Bitcoin increases by 5%, their total holdings will be $115, meaning they would only owe an additional $15 ($115 – $100 = $15). This creates a perverse incentive for investors to hold onto their investments rather than sell and buy back into the market.

The Case Against Bitcoin Lending

While it is theoretically possible to imagine a system in which Bitcoin lending creates added value, there are several concerns that make this unlikely:

- Scalability: The current credit infrastructure is plagued by scalability issues, making it difficult to efficiently lend and borrow Bitcoin.

- Regulatory Uncertainty

: Governments and regulators are still grappling with how to classify Bitcoin as a currency or a security. This uncertainty can stifle innovation and create unnecessary risks for both lenders and borrowers.

- Security Concerns: The lack of regulation in the lending industry has led to an increase in fraud, phishing attacks, and other malicious activities.

Potential Consequences

If Bitcoin lending were to become more common, it is likely to increase market volatility, especially among investors. The potential consequences of creating debt in the digital currency system are far-reaching:

- Increased Speculative Buying: If people feel they can earn additional value by lending Bitcoin, they may be more inclined to invest in the market, which could drive up prices and potentially lead to asset bubbles.

- Reduced Investment in Physical Assets: As investors increasingly focus on high-yield lending opportunities, they may choose to allocate their investments to real assets such as stocks, bonds, or other commodities rather than owning cryptocurrencies.

Conclusion

While the idea of Bitcoin lending is intriguing, it is important to understand the potential risks and implications. Creating debt in a digital currency system creates an inherent paradox: how can we create value when the total supply is limited?