Public Sale, Isolated Margin, Perpetual

Here is a comprehensive article on the three types of cryptocurrency trading platforms you mentioned:

Title: Exploring the World of Cryptocurrency Trading Platforms: An Overview of Cryptocurrency Exchanges, Segregated Reserves, and Perpetual Markets

Introduction

The world of cryptocurrency has seen rapid growth in recent years, with new exchanges and markets constantly emerging. In this article, we will explore three types of cryptocurrency trading platforms: public sale, segregated margin, and perpetual. Each platform offers unique opportunities and advantages for traders, investors, and market participants.

Public Sale Exchanges

A public sale exchange is a type of cryptocurrency marketplace where buyers can purchase the latest cryptocurrencies for fiat currency or other cryptocurrencies. These exchanges are often sponsored by well-known companies or organizations and have strict listing guidelines. Some popular public trading exchanges include:

- Binance: One of the largest and most stable public exchanges, offering over 500 cryptocurrencies.

- Huobi: A prominent exchange with a large user base and extensive registration fees.

- Bitfinex: A high-speed exchange known for its low fees and competitive terms.

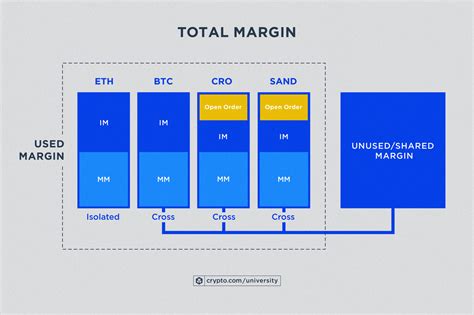

Isolated Margin Trading

Isolated margin trading is a type of cryptocurrency trading platform that offers both cryptocurrency and fiat currency pairs, as well as margin trading. These exchanges allow traders to buy or sell cryptocurrencies with the option to borrow additional funds from the exchange’s treasury. Isolated margin exchanges typically have lower fees than traditional exchanges, making them attractive to traders who want to leverage their deposits.

Some popular isolated margin swaps include:

- BitMEX: A pioneer in the isolated margin space, offering a wide range of cryptocurrency pairs and competitive terms.

- Kraken: A well-established exchange that offers both cryptocurrency and fiat currency pairs, as well as margin trading.

- Saxo Bank: A Swiss bank that offers an integrated cryptocurrency trading platform with isolated margin capabilities.

Perpetual Markets

A fixed market is a type of cryptocurrency exchange where traders can buy or sell cryptocurrencies without a fixed price quote. These exchanges use algorithms to automatically adjust prices based on market conditions, eliminating the need for human intervention. Perpetual markets are often used by large institutional investors and traders who want to manage their positions efficiently.

Some popular perpetual markets are:

- BitMEX: Known for its fast execution speeds and competitive terms.

- Huobi: Offers a wide range of perpetual markets with low commissions and high liquidity.

- Saxo Bank: Offers an integrated cryptocurrency trading platform with constant market opportunities, as well as other financial instruments.

Conclusion

In conclusion, the world of cryptocurrency trading platforms is constantly evolving, with new exchanges appearing regularly. Understanding the differences between public sales, segregated reserves, and perpetual markets can help traders, investors, and market participants make informed decisions about which platform to use. Whether you are an experienced trader or just starting out, it is important to research and choose a platform that meets your needs and offers the features and benefits you want.

Additional Resources

- Exchange Platforms: For a complete list of cryptocurrency exchanges, including public sales, isolated margin, and permanent markets, visit [www.exchangeplatforms.io] (

- Cryptocurrency Trading Resources: For more information on cryptocurrency trading strategies, market analysis tools, and educational resources, visit sites like [www.crypto.com]( or [www.tradingview.com](