Liquidity, Market Sentiment, Decentralized Exchange

The Rise of Cryptocurrency: How Liquidity and Market Sentiment Are Shaping the Industry

The cryptocurrency market has undergone significant transformations over the past decade. From its beginnings as a niche investment opportunity to its current status as a mainstream phenomenon, cryptocurrency has evolved into a complex and dynamic industry that is influenced by a variety of factors, including liquidity and market sentiment.

Liquidity: The Key to Accessing Cryptocurrency Markets

Liquidity refers to the ease with which users can buy and sell cryptocurrencies without experiencing significant price volatility. In other words, it is the ability to enter or exit a trade quickly and at a fair price. High liquidity is crucial for several reasons:

- Market Stability

: Liquidity helps maintain market stability by preventing large price fluctuations that could result in significant losses.

- Risk Management: It allows traders to manage risk by setting stop-loss orders and taking profits before prices drop significantly.

- Institutional Adoption: Liquid markets are more likely to attract institutional investors, who can inject capital into the market.

Market Sentiment: The Elephant in the Room

Market sentiment refers to the collective attitude of investors and analysts towards a particular cryptocurrency or market trend. Positive sentiment is characterized by optimism, while negative sentiment is marked by pessimism. Market sentiment has a profound impact on cryptocurrency prices:

- Price Movements: Market sentiment influences price movements by affecting investor confidence and risk appetite.

- Investor Behavior: Sentiment drives investor decisions, including whether to buy, sell, or hold positions.

- Regulatory Environment: The influence of government policies and regulations can have a significant impact on market sentiment.

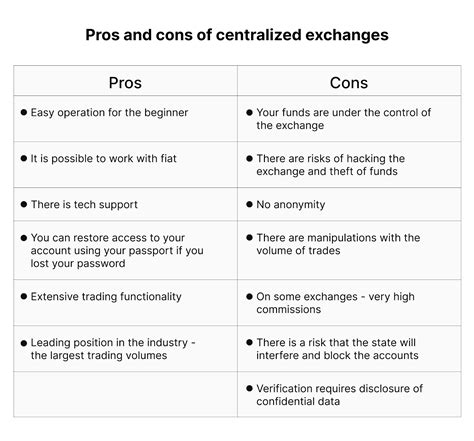

Decentralized Exchanges: A Key Player in the Cryptocurrency Market

Decentralized exchanges (DEXs) are online platforms that allow users to buy, sell, and trade cryptocurrencies without relying on a centralized exchange. DEXs have disrupted traditional exchange models, offering a range of benefits:

- Price Discovery: DEXs enable price discovery by allowing multiple market participants to set prices for their assets.

- Low Fees: DEXs often charge lower fees than traditional exchanges.

- Increased Transparency: DEXs provide detailed information about the trading ecosystem, including liquidity pools and order book data.

The Future of Cryptocurrencies: Liquidity and Market Sentiment

As cryptocurrencies continue to evolve, liquidity and market sentiment will remain critical factors in shaping its trajectory. As more investors and institutional players enter the market, liquidity will become increasingly important to maintain stability and facilitate price movements.

Market sentiment is likely to influence investor behavior, with positive sentiment driving prices while negative sentiment leads to declines. DEXs will continue to play a critical role in the cryptocurrency market by enabling price discovery, reducing fees, and increasing transparency.

In conclusion, liquidity and market sentiment are crucial factors shaping the cryptocurrency industry. As investors and traders navigate the complex landscape of cryptocurrency markets, understanding these dynamics is essential to making informed decisions and succeeding in this exciting space.