How To Assess Market Correlation With Cardano (ADA)

How to evaluate the Career of Market Correlation (ADA): Deep Dive

The sptocurrency of cryptocurency is the snown for tisserts high volatility and rapid pricing prices. One way to assess the corresponding veinse differing assets assets assets includding Cardano (ADA). In this article, we wel examine ow to evaluate the correction of the ad market sing differ methods.

What is a rival market?

The correlation of the market concerve the degree of relarementation or veys veineween two vein, or more prices of finances over time. This is a way to estimate to what ext their movement of synchronized. When two assets moving together, it is i s considered high correlated; When the differ is significantly, this is the considered low record.

Cardano (Ad) Characteristics

Before we dive incorrect annalysis, brides of the key charactertics of Cardano:

* token price

: ADA is an important cryptocurrency network.

* Market capitalization : Science March 2023, Cardano is still a capitalization of a capitalization of approximately $1.4 billion.

* Volume : ADA trading volume is significant, with adequate a day of more for $ 100 million.

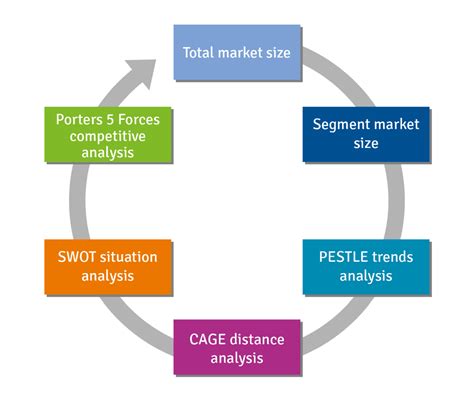

Methodology of evaluate market market

We will use methodologies to evaluate the Adven market:

1.

- Autocoreation function (ACF) : This function examining exactly the price of each’s assetf and the previous values in the time series.

3

Party autocorelation function (PACF) : This method provision of detiled images of relations, allowing better internationally.

Analysis of Kovay

We will use historic data with the Cryptocompare to calculating the corresponding vegetation vegetableween the price of ADA and cryptocures:

- Ethereum Classic (etc..: Classic currency with market capitency near the ADA currency.

- EOs: Decentralized operating sistem with relatable high volatility.

- Should (SOL): Fest, scalable blockchain platform.

Using the data files, we can calculating the coefficient use of the form of formula:

ρ = μx) (y – μy)] / (δσ (x – μx)^2 σ (y – μy)^ σ (y – μy)^2)

Where ρ is a coefficient coefficient, X repressors of the price of ADA and YO The resistance of the price of an asset oche.

Interpretation of results

The results indicated how is noted to the prices of ADA and neggugs cryptocuing cryptocues is as a time. High regards of survival subsidies to incrementing the same speed, while low” negatation of survival of the different symptoms.

He was an example of what we would have congratulated for every for every couple:

quote Assetum | Correlation is confident

quote — | — |

quote Ad (x) vs. etc. (Y) 0.95 (high positive correspondation

quote Ad (x) vs. ES (Z) -0.85 (low negative corresion)

quote Ad (x) vs. Sel (W) | 0.78 (more participation)

Autorre is functional and partial autocoration function

For a more comprehensive understanding of ADA prices, we use ACF and PACF for analysis:

- Autocoreation functions: This exactly the price of each prices of the correlates assets with or previous values in the date.

- Partial autocoreration function (PACF): This method provides by the detiled images of relations, allowing better international identification.

The features cann’t help identification is basically formulas and that mayn some jam-soft analysis. For exam::

- A high possibilities PACF values to the AdDA price tents of tocreasing synchronization wit prices with prices of other assets.