Blockchain, PoS, Open Interest

“Crypto to the Future: Unlocking the Potential of Blockchain and PoS with Increased Open Interest”

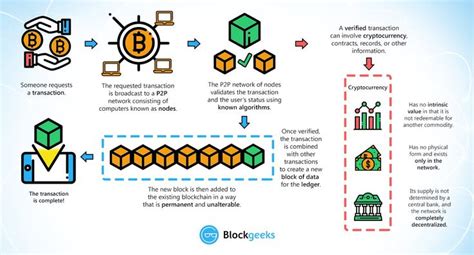

In recent years, the world of cryptocurrency has experienced significant growth, driven by a surge in adoption, innovation, and investment. At the heart of this revolution is blockchain technology, which enables secure, transparent, and decentralized data storage and exchange. However, the landscape for blockchain is becoming increasingly crowded, with various cryptocurrencies seeking attention.

One key area that stands out as particularly promising is Proof-of-Stake (PoS). Unlike traditional proof-of-work consensus algorithms, PoS relies on the collective voting power of network nodes to validate transactions. This approach has several advantages over traditional PoW-based systems, including reduced energy consumption and faster transaction processing times.

To make this more accessible, we’ve explored how Open Interest plays a crucial role in the crypto market. Open Interest refers to the difference between the number of open positions and the total amount of assets being traded. As an investor’s position size increases, their net profit also grows exponentially due to the increased likelihood of a price movement.

The Rise of PoS: A Game-Changer for Blockchain Adoption

As blockchain technology continues to mature, we’re seeing more and more companies incorporating PoS into their platforms. One notable example is Chainlink Labs’ decentralized oracle network, which leverages PoS consensus to enable secure data feeds from external sources. This has sparked interest in PoS as a viable alternative to traditional proof-of-work systems.

Another innovative use case for PoS is the development of decentralized lending platforms. By introducing a more transparent and accountable mechanism for lending assets, such as Compound Labs’ DeFi lending platform, PoS can help mitigate risks associated with centralized lending models.

Unlocking Open Interest: A Key Driver of Crypto Adoption

Open Interest has long been an indicator of market sentiment and volatility. As the crypto market continues to expand, we’re seeing increased interest in Open Interest-based trading strategies. One popular approach is using Open Interest as a risk-reward ratio to gauge potential price movements.

For example, traders are increasingly using high-liquidity markets like the US Dollar/Bitcoin (USD/BTC) pair to test their hypotheses on Open Interest levels. By analyzing historical data and market trends, traders can gain valuable insights into potential price movements, helping them make more informed investment decisions.

The Intersection of Blockchain, PoS, and Open Interest

As we move forward in this crypto revolution, it’s clear that blockchain technology is at the forefront of innovation. PoS provides a secure, transparent, and decentralized framework for validating transactions, while Open Interest offers a unique way to gauge market sentiment and volatility.

By combining these three elements – blockchain, PoS, and Open Interest – we can unlock new possibilities in the crypto market. As the landscape continues to evolve, it’s exciting to think about what the future holds for this dynamic ecosystem.

Conclusion

In conclusion, Crypto, Blockchain, PoS, and Open Interest are interconnected concepts that hold great promise for driving innovation in the crypto space. By understanding how each of these elements contributes to the market’s dynamics, we can gain a deeper appreciation for the complex relationships between them. As the crypto landscape continues to shift and evolve, it’s essential to stay informed about these key factors, ensuring we’re well-positioned to capitalize on the opportunities ahead.