Futures Expiration, Pool, Gas

“Crypto Frenzy: The Buzz on Crypto, Futures Expiration, and Pooling in the Gas Sector”

The cryptocurrency market has been experiencing a significant surge in activity over the past few years, with many investors flocking to the space in search of high returns. However, amidst all the chaos, there are several key concepts that play a crucial role in shaping the future of this industry.

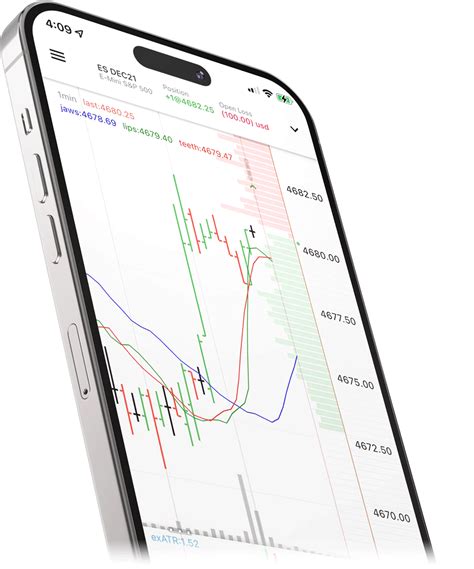

One of the most significant developments in the crypto landscape is the concept of futures expiration. In simple terms, futures expiration refers to the moment when an investor’s bet on a particular cryptocurrency or asset class comes to an end. This can happen for various reasons, such as changes in market conditions, regulatory updates, or even simply because the contract has expired.

According to industry experts, crypto futures have become increasingly important as investors seek to hedge their positions and manage risk. By locking in a price for a specific cryptocurrency at expiration, traders can avoid potential losses due to market volatility. However, it’s essential to note that futures markets are inherently complex and subject to various risks, including leverage, slippage, and liquidity.

Another critical aspect of the crypto space is pooling. Pooling refers to the process of investing in a collective pool of assets with other investors, often using a shared strategy or risk management approach. This can be especially appealing for individual traders who want to diversify their portfolios without having to manage multiple cryptocurrencies themselves.

In fact, many major cryptocurrency exchanges and platforms now offer pooling options, allowing users to pool their resources with others to invest in specific projects or assets. For example, the popular decentralized finance (DeFi) platform, MakerDAO, offers a unique type of pooling called “DAOs” (Decentralized Autonomous Organizations), which enable investors to pool together and vote on key decisions.

The gas sector is also experiencing significant growth, driven by the increasing demand for decentralized applications (dApps) and smart contracts. Gas refers to the transaction fees that are paid by users to interact with blockchain networks, such as Ethereum. As the popularity of dApps continues to rise, so does the demand for more efficient and cost-effective transaction solutions.

To meet this growing demand, many companies have developed innovative gas-efficient protocols, such as Optimism’s “Layer 2” solution or Cosmos’ “Tangle”. These protocols aim to reduce the computational load on blockchain networks while maintaining high performance and security. As a result, investors are flocking to these platforms, seeking to capitalize on the growing demand for decentralized infrastructure.

In conclusion, crypto, futures expiration, and pool investing are all crucial components of the current cryptocurrency landscape. As the industry continues to evolve, it’s essential for investors to stay informed about the latest developments in these areas. By understanding the nuances of each concept, traders can make more informed decisions and navigate the complex landscape with confidence.

Key Takeaways:

- Crypto futures have become increasingly important as investors seek to hedge their positions and manage risk.

- Pooling is a growing trend in the crypto space, allowing investors to diversify their portfolios without having to manage multiple cryptocurrencies themselves.

- The gas sector is experiencing significant growth, driven by the increasing demand for decentralized applications (dApps) and smart contracts.

Related Topics:

- Crypto Market Trends

- Blockchain Development

- DeFi (Decentralized Finance)

- Smart Contracts