How To Analyze Market Depth For Better Trading Decisions

Cryptocurrency Market Deep Power Unlock: Better Trade Solutions Manager

The cryptocurrency trading world has risen rapidly in recent years as prices have been very fluctuated from days to minutes. One essential aspect of successful trade is to analyze the depth of the market, which indicates the amount of buyers and sellers involved in a certain price level. In this article, we will delve deeper into how to analyze the depth of the market for better trading solutions, helping you make more reasonable investment decisions.

What is the depth of the market?

The depth of the market includes different types of orders such as limited orders, STOP-LOSS orders and market orders, monitoring, which may be affected by different factors such as liquidity, order flow and market mood. Market depth analysis helps merchants identify areas where prices are stable or unstable, making it easier to predict price changes.

Types of market depths of the market

Here are the division of orders for the depth of the market:

- Limited orders : These orders are placed at specific prices and can be executed at the best available price. Limited orders help you buy or sell at a selected level.

- Stop-Loss orders can be used to protect against rapid price drops.

- Market Orders : These orders are placed without any specific price and will immediately fulfill according to market conditions. Market orders help you get to the market quickly.

Market depth analysis

To effectively analyze the depth of the market, follow the following steps:

- Historical data analysis

* How often do prices reach certain levels?

* If prices tend to abandon or go beyond specific levels.

- This will help you understand the liquidity and spread of buyers and sellers.

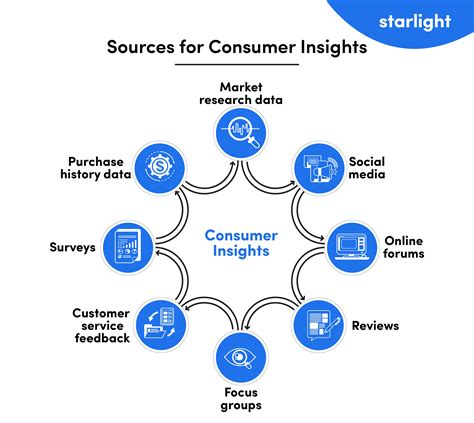

- Market Mood Analysis : Observe social media, news locations and online forums to appreciate market moods. A strong attitude can mean high interest in assets, and in weak moods can show resale or underestimated conditions.

- Basic Analysis : Evaluate the main factors that lead to certain changes in cryptocurrency prices such as:

* Economic indicators

* Industrial trends

* Government regulations

Determination of high market depths

When analyzing the depth of market, look for areas with:

- High liquidity : Many buyers and sellers show a more liquid market.

- Low volatility : Low volatility may assume that prices are stable or have reached balance.

- A strong market approach : If prices tend to go beyond specific levels or show a strong mood, this may be a sign of potential price changes.

Better trade solutions

After analyzing the depth of the market and determining the high liquidity, the weak variability and the strong mood of the market, you can make more informed trading decisions:

- Entrance and Exit points

: Determine the optimal entry and output points based on your analysis.

2.

3.

Conclusion

Market depth analysis is an essential aspect of successful cryptocurrency trading. By understanding the various types of orders, analyzing historical data and determining high liquidity, weak variability and strong market mood, you can make more reasonable investment decisions. Remember to remain disciplined, set a clear Stop-Loss level and trade according to your risk tolerance.