How To Assess Market Dynamics For Better Trading Strategies

How to Assess Market Dynamics for Better Cryptocurrency Trading Strategies

The world of cryptocurrency trading is highly volatile, and making informed decisions is crucial to success. With the rapid growth of the market, it’s essential to stay ahead of the curve by understanding how to assess market Dynamics. In this article, we’ll explore the key factors to consider when evaluating market trends and providing tips on how to incorporate them into your trading strategies.

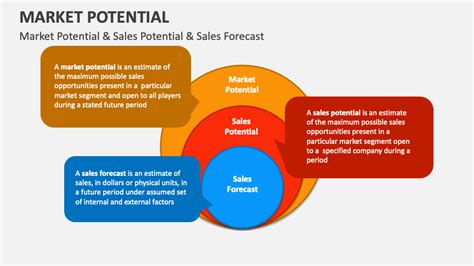

Understanding Market Dynamics

Market Dynamics Refer to the interactions between various components that make up a System Market. In cryptocurrency trading, these components include supply and demand forces, institutional investment, regulatory environment, technological advancements, and more. Assessing Market Dynamics Involves Analyzing these factors to determine their impact on price movements and overall market trends.

key factors to consider

- Supply and demand : The balance between Buying and selling pressure can significantly influence market prices. Analyze the latest economic data, such as GDP growth rates, inflation rates, and employment numbers, to gauge supply and demand.

- Institutional Investment : Institutional Investors, Such as Hedge Funds and Family Offices, are increasingly investing in cryptocurrencies. Their investment patterns can impact market trends.

- Regulatory Environment : Changes in Government policies or regulations can significantly affect cryptocurrency prices. Stay informed about updates on regulatory frameworks, tax laws, and anti-money laundering (AML) requirements.

- Technological Advancements : New Developments in Blockchain Technology, Decentralized Finance (Defi), and other emerging areas can impact market Dynamics.

- Global Economic Conditions : External factors like Global Economic Growth, Trade Wars, and Currency Fluctuations Can Influence Cryptocurrency Prices.

Market feeling analysis

To gain a betteranding of market sentiment, analyze the following indicators:

- Volatility

: Assess the level of price volatility in your chosen cryptocurrency.

- Price movement : Analyze the trend of recent price movements to gauge market confidence.

- Support and Resistance levels : Identify key levels whereby buying or selling pressure is concentrated.

- Risk-Return Tradeoff : Evaluate the Relationship between Risk and Potential Returns in Your Chosen Cryptocurrency.

Incorporating Market Dynamics Into Your Trading Strategies

By Incorporating Market Dynamics Analysis Into Your Trading Strategies, You Can:

- anticipate price movements : Develop a better understanding of market trends and anticipate price movements to make informed decisions.

- Identify Risk-Reward Relationships : Understand how risk effects returns in cryptocurrencies, helping you to position yourself for optimal profits.

- Adjust your trading plan : Adapt your trading plan to respond to changing market conditions, ensuring that you are always on the right side of the market.

Best Practices

To effectively assess market dynamics and incorporate them into your trading strategies:

- Stay up-to-date : regularly update yourself on Market News, Trends, and Regulatory Developments.

- Use Multiple Indicators : Analyze various indicators to gain a comprehensive understanding of market sentiment and dynamics.

- Be Flexible : Remain Adaptable to Changing Market Conditions, Adjusting Your Strategy As Needed.

- Continuously Learn : Educate Yourself on New Technologies, Regulations, and Market Trends to Stay Ahead of the Competition.

Conclusion

Assessing Market Dynamics is crucial for successful cryptocurrency trading.