How To Conduct A Risk Assessment For Your Crypto Portfolio

How to conduct a risk assessment for your Crypto portfolio

The world of cryptocurrency has been experienced rapid growth and a significant price of fluctuations in recent years. As more people become aware of others. However, with this growing interest increased the disc, since the volatility of marketet can involve significant losses. The conduct of a Misk Assssment is anyone who tries to do or manage the portfolio for Therpto.

What is risk assessment?

Ask Assssment is the process of identifying the potential associated with an investment or financial decrease. In the context of investments in cryptocurrency, it involves the evaluation of the probability and potential impact of several brands on your wallet. By understanding these risks, it is possible to make informed decisions on how to manage ilem and minimize potential losses.

Why management of a risk assessment?

Conducting a rice intake is essential for several resonce:

- Protect your capital

: Cryptocurrency investments involved significant risks, including market fluctuations and price withdrawals. In -depth risk assistance can help you identify the areas that your wallet can be endured for losses.

- Managing market volatility : cryptocurrency markets are a booking for volatility, it is a quick result at a quick price. By evaluating the potential of the fluctuations of your wallet, you can take halfway measures.

- Divers your portfolio : a diversified portfolio is more resilient for brands and sing the periods of volatility.

40 decisions.

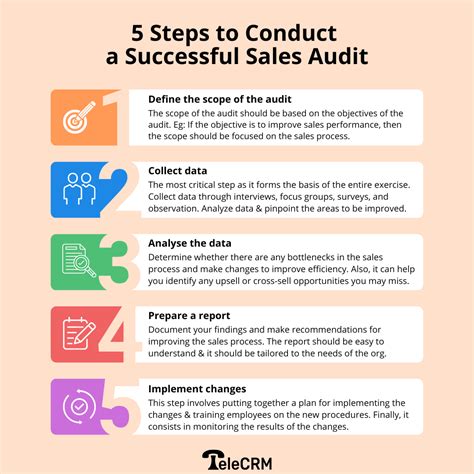

How to conduct a risk assessment

Conducting a rice ass for your portfolio implies the following steps:

– Short -term earnings).

- Understanding the market trends : Research market trends and grazing the post-Differren on the post-Cripperren.

3

* Market volatility

* Regulatory changes

* Risk safety (e.g. hacking)

* Risk liquidity (e.g. market reorganization or mainly falls)

- Evaluate your portfolio : evaluate the current composition and profile of your wallet disc to identify the areas toxicated by toxic.

- Divers your portfolio : take into consideration the diversification of the wallet in different in different closes of activities, such as actions, bonds and goods, to reduce overall risk.

- Monitor and regulate

: Monitor the brands continuously and regulates your wallet in agreement.

Risk assessment framework

Here is a suggested framework to conduct an assignment of Misk:

- Risk categories

* Market risk (e.g. price fluctuations)

* Risk of liquidity (e.g. market recession or price drop)

* Safety risk (e.g. hacking)

- Risk levels

* Low: minimum impact on the wallet

* Medium: impact at moderate risk

* High: significant impact of risk

- Magnitudes at risk

* Low: 1-10%

* Medium: 11-50%

* High: 51% or higher

Example: conduct a risk assessment for the encryption portfolio

Suppose you have invested $ 10,000 in a cryptocurrency portfolio composed of Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). You have conducted research on brandt trends and identify the following risks:

- MARKING RISK : MARKET FLUTUTTATIONS can involve drop or price gains.

2.