How To Use Candlestick Charts For Effective Trading Analysis

How to use candle maps to efficiently analyze trading

Candle charts have been the basis of technical analysis in financial markets for decades. These visual representation of prices and trend movements is widely used by traders, investors and analysts to analyze market behavior and adopt informed business decisions. In this article, we will dive into the world of candlestick maps and explore how to use them effectively to analyze trading.

What are candles cats?

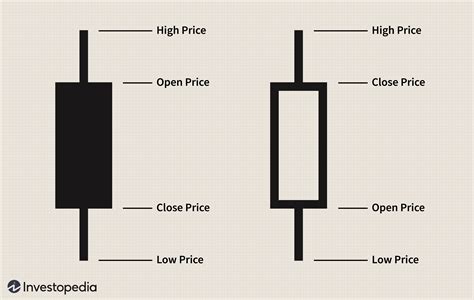

Candle charts are a type of technical graph that shows high, low, open, closed and volumetric (hhlvo) prices for specific actions or assets at a particular period. These graphs are created by drawing horizontal lines at key levels on the grid, which represent movements and trends in prices.

Types of candlestick graphs

There are several types of candle charts used by traders to analyze market behavior:

- Simple Candle Cat : Basic candle table with five main candles (upside down, closed, open, high, low) and no further information.

- Intratay Candlestick Chart : A graph showing a price action for a specific business day, including all five main candles.

- Hourly Candlestick Chart : Graph showing a price action for one hour of trading in five main candles.

- Daily Chart of Candlesticks : Graph showing the overall trend of the market and volatility for 24 hours.

How to read cats of candlesticks

Reading candlestick charts requires some knowledge of the basic concepts of technical analysis, for example:

1.

- Support and resistance levels : identify key support and level of resistance that may affect market behavior.

- Volume Analysis : Consider volume data in the chart to detect market sentiment and momentum.

Effective Analysis of Candle Charts

Follow the following steps to effectively use candlestick graphs to analyze trading:

- Identify the type of graph : Select a chart type that suits your business strategy (eg intraday or daily).

- Analyze the graph : Look at the candle pattern and try to identify trends, support and resistance.

- Search patterns

: Identify any recurring patterns such as waves, triangles or wedges.

- Use technical indicators : To improve analysis, consider using technical indicators such as sliding diameters or RSI.

- Consider market conditions : Consider market conditions such as intelligence events or release of economic data.

Examples of candle chart

Here are some examples of candle charts used to analyze trading:

- Bullish chart that shows a long -term trend and a large volume in the daytime chart of candles:

`

+—————-+——————–+———————-

| H | L | O |

| 10-13-2023 | 20-23-2023 | 25-28-2023 |

+—————-+——————–+———————-

`

- Bearish graph that shows a short -term trend and low volume in the daytime candle graph:

`

+—————-+——————–+———————-

| H | L | O |

| 15-18-2023 | 25-28-2023 | 30-33-2023 |

+—————-+——————–+———————-

`

Conclusion

Candle charts are a powerful tool for traders and investors to analyze market behavior and adopt informed business decisions. By understanding various types of candle charts, identifying key formulas and using technical indicators in conjunction with the chart analysis, you can develop effective business strategies to help you succeed in the markets.

Remember that candles maps are just one part of a complete business strategy.