Systemic Risk, Market Dynamics, Liquidity Pool

Complex cryptocurrency complex network: Understanding the risks and dynamics of cryptographic markets

The world of cryptocurrency has experienced dazzling growth in recent years, prices that have risen towards the Vertiginous Summits and investors are demanding an action. However, on the surface of this seemingly liquid market is a complex network of systemic risks, market dynamics and liquidity pools, which have a high scope for individuals, institutions and governments.

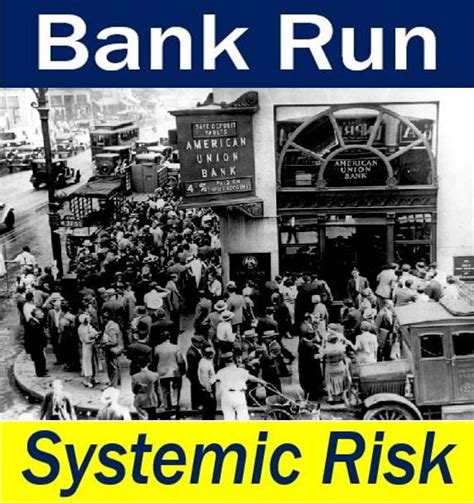

Systematic risk: The quiet killer

The systemic risk refers to the inherent instability of an entire financial system that can lead to a failure that has a devastating effect on the wider economy. In the context of cryptocurrency markets, systemic risk is particularly acute due to the following factors:

- Lack of regulation : Cryptocurrency markets operate outside the traditional regulatory framework, which makes it difficult to monitor and regulate the activities of the authorities.

- High Volatility

: Cryptocurrencies are known for their extreme price fluctuations, which can lead to rapid capital outputs and market volatility.

- Decentralized Nature : Cryptocurrencies operate on a large decentralized book (blockchain) that makes it difficult to follow transactions and identify individuals or entities involved in prohibited activities.

These factors create an environment that promotes systemic risk, where even minor disorders can have significant consequences. For example:

- The hacking event can jeopardize the safety of the big cryptocurrency exchange, exhibiting user funds and leading to a cascade crisis.

- A sudden increase in the demand for a particular cryptocurrency can increase prices, supply chains and market volatility.

Market dynamics: the unpredictability factor

Cryptocurrency markets are characterized by their unpredictability. Prices can fluctuate wildly for a few minutes, with little motifs or logic behind movements. This unpredictability is due to many factors, especially:

- Lack of transparency : Cryptocurrencies and market participants often do not access detailed information on transactions, which makes it difficult to identify models or disorders.

- Marking of the market

: Speculators and merchants can take part in manipulation tactics such as pump and flipper samples to artificially increase prices.

- Excessive rely on social media : Social media platforms have become the main source of information on the market, but their reliability is questionable.

As a result, an environment where investors continue to rush to interpret the dynamics of a rapidly developing market. For example:

- A sudden increase in the demand for a given cryptocurrency can lead to a rapid increase in prices, which can be followed by a high repair when investors take risk.

- The spread of desinformation or speculation related to cryptocurrency performance can increase prices without underlying logic.

Liquidity Basin: Unbearable Growth

Cryptocurrencies are often characterized by their extremely low liquidity, which makes it difficult to buy and sell a large amount of components. This lack of liquidity creates an environment that promotes market manipulation, where speculators can use the arm effect to strengthen their profits while minimizing their losses.

However, the rapid increase in liquidity is not lasting in the long run. As more and more people are joining the cryptocurrency market, demand is increasing, leading to new price increases and reduction in supply. This creates a vicious circle of speculation and overestimation that may collapse:

- If sufficient investors start selling a particular cryptocurrency at high prices, the remaining parts are very vulnerable to the clear correction.

- Increase in liquidity demand can lead to a reduction in trading volume to exacerbate market volatility.