Technical Valuation Methods For Analyzing Aave (AAVE) And Market Trends

Technical evaluation methods to analyze AAVE (AAVE) and market trends

The cryptocurrency world has experienced rapid growth in recent years, with many new projects emerging to capitalize the hype. Among them is AAVE (previously known as distribution), a decentralized loan protocol that gained significant traction of its launch in 2018. In this article, we will explore the technical assessment methods to analyze to analyze.

Understanding Aave

AAVE is a decentralized loan platform that allows users to lend and lend cryptocurrency without the need for intermediates such as banks or traditional exchanges. The protocol uses an exclusive algorithm called “Defi” model (decentralized finances), which allows loans, loans and negotiations of various cryptocurrencies such as ETH, USDC and DAI.

Technical Assessment Methods

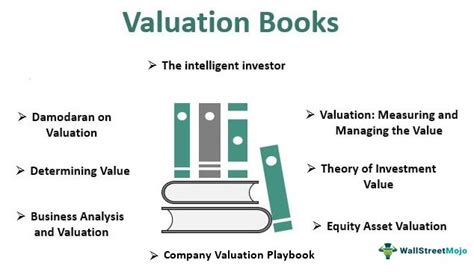

To analyze the trends of AAVE and the market, we need to understand some methods of technical value. Here are some main ones:

- Price ratio (p/b) : This method compares the current price of a security with the accounting value (also known as liquid asset value). Give investors an idea of whether the company’s assets are overvalued or undervalued compared to their liabilities.

- Helps investors determine whether an action is very expensive or very expensive in relation to their potential earnings.

- Mobile averages

: These are technical indicators that measure the average price of an asset over a period of time. They can help identify trends and predict future price movements.

- Relative Strength Index (RSI) : This indicator measures the magnitude of recent price changes to excessively determine Bought or Bought.

Technical Analysis of AAVE

Now, let’s apply these value methods to analyze Aave:

- Price-Lucro Reason (p/e) : AAVE has a relatively high ratio compared to other cryptocurrencies in the market. According to Coinmarketcap, the AAVE ratio is about 15, indicating that investors are willing to pay a prize for this project.

- Mobile Average : AAVE’s Short Term Move (SMA) is currently around $ 19.50, while the long -term SMA is $ 24.20. This indicates that the price has a tendency up in recent months, suggesting a strong demand for the asset.

- Relative Strength Index (RSI) : AAVE RSI is currently in 44, indicating that it is excessive. However, this does not necessarily mean that the asset decreases in the short term.

Market trends

In addition to technical analysis, market trends are also crucial in analyzing AAVE:

- Feelings Analysis : Analyzing the feeling of investors and traders can provide valuable information about market trends. If a significant number of investors are buying or selling AAVE, it may indicate strong demand.

- Community Feeling : The attitude of the community in relation to AAVE is also essential to understanding market trends. The positive feeling of communities such as Reddit R/AAVE and other on -line forums may be indicative of market interest.

3.

Conclusion

Technical assessment methods are essential to analyze AAVE and understand market trends. By applying these methods, investors can obtain valuable information on asset price movements, feelings and potential growth prospects. Although there is always a risk of error or bias when using technical analysis, this article has provided a solid foundation to explore AAVE through technical evaluation.

Recommendations

Based on our analysis:

* Buy: If you believe AAVE’s long -term potential, consider investing in the asset.