The Role Of Crypto Exchanges In Price Discovery

The Role of Crypto Exchanges in Price Discovery

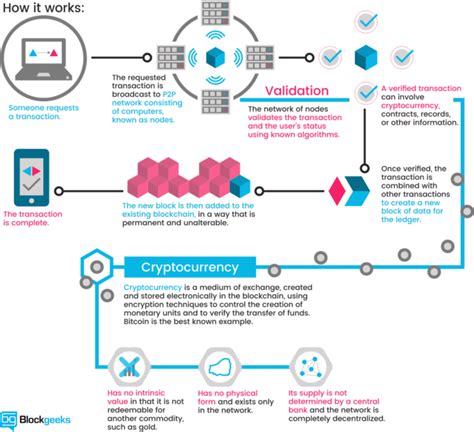

In the world of cryptocurrency, price discovery is a crucial aspect that enables investors to make informed decisions about buying and selling digital assets. Cryptocurrency exchanges have become indispensable tools for traders and investors, providing a platform for users to buy, sell, and trade various cryptocurrencies.

What are Cryptocurrency Exchanges?

Cryptocurrency exchanges are online platforms that allow users to exchange one cryptocurrency for another using their respective digital currencies’ (DC) native tokens or fiat currency. These exchanges facilitate peer-to-peer trading, enabling users to buy and sell cryptocurrencies at competitive prices. Cryptocurrency exchanges can also offer a range of services, including market data, order management, and user support.

The Role of Crypto Exchanges in Price Discovery

Cryptocurrency exchanges play a vital role in price discovery by providing real-time market data and facilitating trades. Here are some ways in which crypto exchanges contribute to price discovery:

- Price Feed: Cryptocurrency exchanges provide price feeds for various cryptocurrencies, including supply and demand indicators, market capitalization, and trading volume. This information helps traders make informed decisions about buying or selling.

- Market Data: Exchanges offer real-time market data, including price movements, trends, and volatility. This data enables users to analyze the cryptocurrency market and make more informed trading decisions.

- Order Book: Cryptocurrency exchanges maintain an order book for each cryptocurrency traded on their platform. This allows traders to view the current state of the market and set prices accordingly.

- Market Sentiment

: Exchanges often publish sentiment indicators, such as trader volume, price movements, and social media engagement, which help identify trends and patterns in the market.

How Crypto Exchanges Facilitate Price Discovery

Cryptocurrency exchanges facilitate price discovery through various mechanisms:

- Leveraged Trading: Exchanges enable traders to leverage their investments with borrowed capital, allowing them to amplify gains or reduce losses.

- Risk Management: Exchanges offer risk management tools, such as stop-loss orders and position sizing, which help users manage their exposure to market volatility.

- Order Book Dynamics

: The order book dynamics on cryptocurrency exchanges provide insights into the market’s sentiment and mood, helping traders identify potential trading opportunities.

The Benefits of Crypto Exchanges in Price Discovery

Using cryptocurrency exchanges facilitates price discovery in several ways:

- Increased Market Efficiency: By providing real-time market data and facilitating trades, exchanges enhance market efficiency.

- Improved Trading Strategies: The information available on cryptocurrency exchanges helps users develop more effective trading strategies.

- Enhanced Research and Analysis: Exchanges enable users to conduct in-depth research and analysis of the cryptocurrency market, which aids in making informed decisions.

Conclusion

Cryptocurrency exchanges play a vital role in price discovery by providing real-time market data, facilitating trades, and enabling traders to develop more effective trading strategies. As the demand for cryptocurrency services continues to grow, exchanges will remain essential tools for investors and traders seeking to participate in the digital asset market.

Recommendations

- Stay informed: Continuously monitor market trends, price movements, and sentiment indicators.

- Diversify your portfolio: Consider diversifying your investment portfolio by allocating a portion of your assets to cryptocurrency exchanges.

3.